IDTechEx Research has released a new report, Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2017-2027.

Many now think that the graphene industry is in the midst of the disillusionment period. Gone is the hype associated with the material. In fact, many now dismiss graphene’s prospects and consider it a failure. Some perspective and patience however is now in order as the process of commercialising new materials is intrinsically slow.

At IDTechEx, we have been closely following the graphene industry over the past five years. We regularly interview suppliers and users, organize the leading events on the topics, and speak at many conferences around the world. We can therefore offer unrivalled insight and intelligence into the graphene market.

The results of our continuous research is this report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2017-2027 which provides you with the most comprehensive analysis of graphene technologies, applications, players whilst offering ten-year segmented market forecasts in USD and tpa.

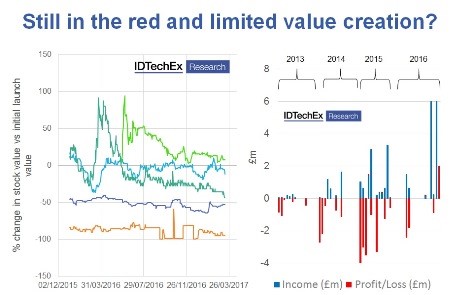

The idea of the disillusionment is reinforced by the fact that the graphene industry remains loss making. This can be observed in the chart below which compares the revenue as well as profit/loss growth of various public and private graphene companies. Observe that revenues have been rising across the board but not as fast as the costs, keeping the industry in the red.

Strong application pipeline

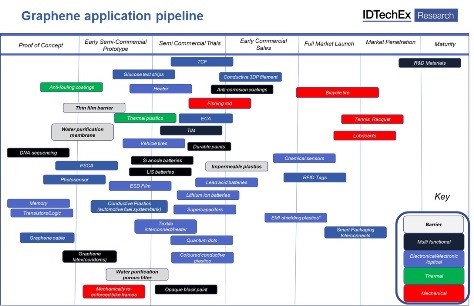

We demonstrate the technology and market readiness level of different graphene applications below. This schematic is constructed after speaking to many suppliers and users, and includes our own internal assessments and insights. Of course, this is not a comprehensive list as potential graphene applications are countless. It however captures most of the key applications, and we believe that it represents the market state well.

The first sector to be commercialized was the R&D sector. In fact, it continues to be the main revenue generator for many. The lead lists of many suppliers continues to be dominated by hundreds of researchers, in companies as well as in academia, seeking samples.

This was expected particularly as companies could only participate in projects demonstrating performance when they only had pilot capability. The absence of credible and assured volume supply excluded participation in real qualification process. This has changed though in the past few years.

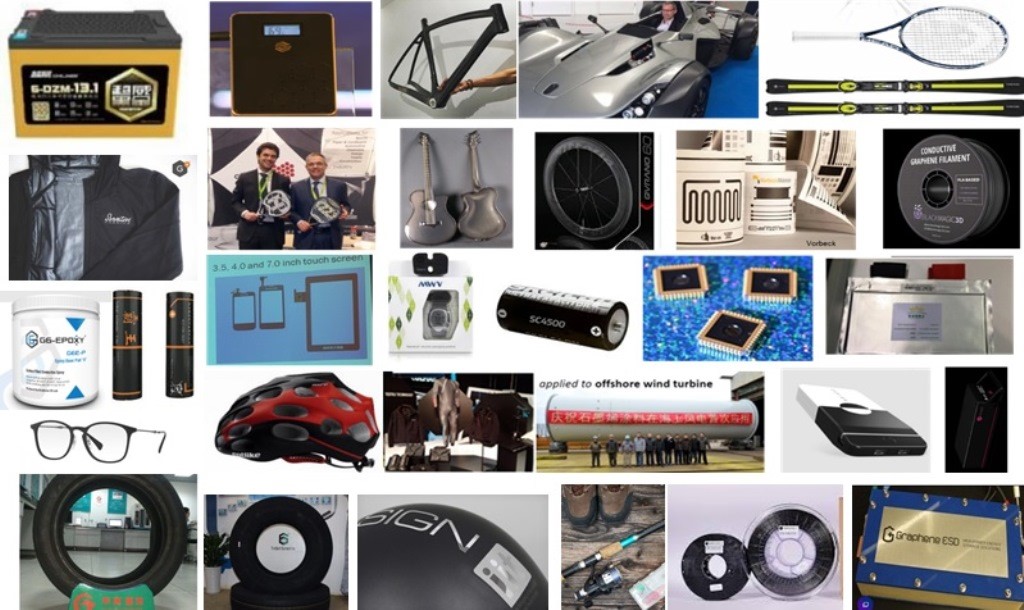

The industry, as observed below, now sees a wave of applications that are in the late commercial prototyping or early sales stages. Indeed, graphene has been going through numerous qualification processes in parallel around the world.

Graphene will not win in all the applications. This is because unlike what one often hears at conferences, graphene is almost always not the only solution in an application. In fact, it is not always the best solution and most often not the least expensive!

It is, however, also implausible to imagine that graphene will fail in all applications too. Indeed, the diversity of target applications inevitably imparts a certain resilience to the graphene market.

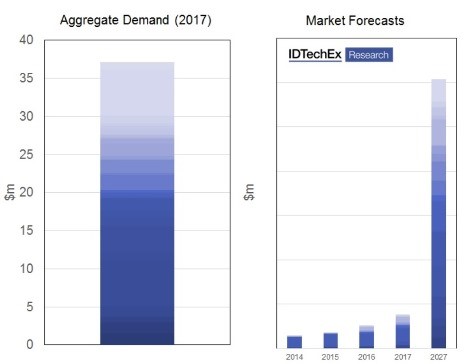

Market snapshot in 2017

The graphene market is in fact already larger than $37m. This is depicted in the left hand side chart below, which shows the company-specific aggregate market at the level of graphene company income. Note that we recently updated this chart by interviewing numerous graphene companies and, where possible, referring to public records. Interestingly, we have included more than 40 companies in our analysis. This demonstrates that most graphene companies have revenue well below $1m.

This suggests that the number of graphene companies exceed what the market can currently sustain. Indeed, we had previously argued that the market will experience a consolidation. We assess that this process has already begun, and will take 3-4 years to fully unfold. This process would have been faster had it not been for, direct or indirect, government subsidies. This is also why we are surprised by the continued rise in the number of graphene companies. We believe that this is fuelled by the signal that subsidies provide to the market.

Volume growth from 2020/2021 onwards

The market growth will continue at rates that are not too dissimilar to the recent past until 2020. The transition away from R&D and towards commercial sales will accelerate. More applications will graduate into commercial sales but the industry as whole will not. This is because different suppliers/buyers are different stages. The growth will accelerate from 2021 onwards. This is thanks to the upcoming wave of applications that are in late commercial prototyping stage (see the application pipeline above). At this point in maturation, volumes will increase and prices will fall further. Ultimately, we assess that the industry will reach around $300m by 2027.

Graphene has all manners of fantastic property. A so-called ‘killer’ application may therefore still be found and transform the fortunes of the industry. The history of CNT, however, suggests that this will be a mightily struggle, but it nonetheless gives out forecasts an upside potential. For more information about this industry refer to Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2017-2027. At IDTechEx, we can truly say that we have been a part of the industry since its inception. We have interviewed and visited the key players, organised the leading business-focused events around the world, and advised many investors and end-users. We can therefore offer unrivalled insight and intelligence into the graphene market.